article Archives

Search the full library

Staying Alive – Financial Projection and Cash Flow for Re-Opening Businesses

The partial re-opening of the economy will be music to the ears of business owners across the province. Many have been champing at the bit for business life to get back to normal. But before diving headfirst back into business operations, it is worth taking stock of

Read more

Taking the Guess Work out of Revenue Forecasts

For any business owner, forecasting growth can be an onerous task – the financial equivalent of a trip to the dentist. But like trips to the dentist, they are important, and not necessarily as painful as you might expect. None of us can see into the future but with

Read more

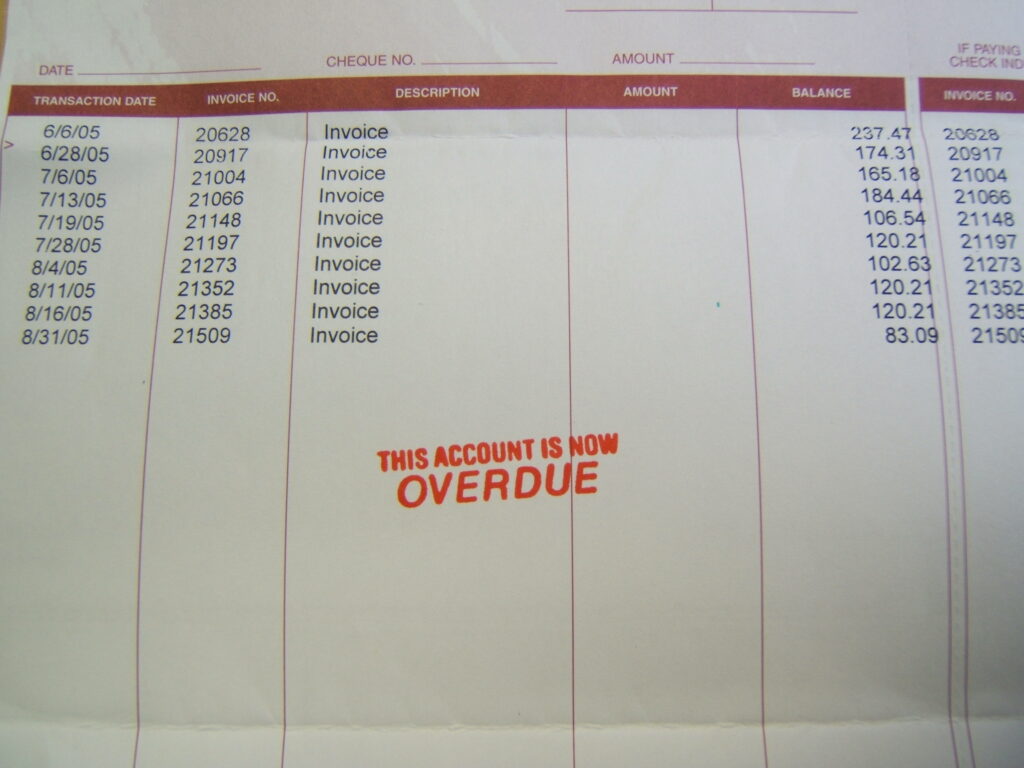

Collecting What’s Owed: The Awkward Side Of Business

People go into business to sell either a product or a specialized service. What they don’t do, is go into business to become debt collectors – unless, of course, they are in the business of debt collecting. Nobody enjoys the collecting part of business and most

Read more

Passing the torch: The complexities of succession planning

Related Content Re-visiting Estate Freezes – a COVID-19 Silver Lining for Business Owners | Three Tax Efficient Strategies for Managing Retained Profits | What to Plan for When Selling Your Business in 2021 It is a common scenario. An entrepreneur has put their heart

Read more

Short of Cash? 8 Alternative Sources of Business Financing

It’s a rare business that doesn’t experience the occasional financial slump. There can be many reasons for a downturn: From an unexpected dip in the national economy to something relatively simple and short term, such as a major customer who doesn’t pay on time.

Read more

Understanding Flow-Through Shares and Their Risks

Flow-through shares are used to invest money on the exploration for resources.

Read more