article Archives

Search the full library

Breaking Barriers: How Women Entrepreneurs Access More Capital

Despite their innovation, resilience, and entrepreneurial spirit, women entrepreneurs continue to face significant challenges in securing the funding they need to grow and sustain their businesses. A panel discussion hosted by GGFL in partnership with the Women’s

Read more

Protect Yourself from Tax Filing Scams

Among the most damaging schemes are those involving false tax filings to claim fraudulent refunds.

Read more

Should Your Professional Corporation Own Your Car?

A common question we get from professionals is whether to buy a car from within their corporation, or to do so personally. There are several things to consider when deciding whether this is an option. In some cases, adding a vehicle to a corporation can lead to

Read more

Navigating the Changes to the Taxation of Capital Gains

Update prepared by Kody Wilson and Émilie Tremblay. What You Need to Know for Your 2024 Tax Filing Making Sense of the Confusion If you’ve been trying to follow the back-and-forth on the changes to the capital gain inclusion rate in Canada over the last few months,

Read more

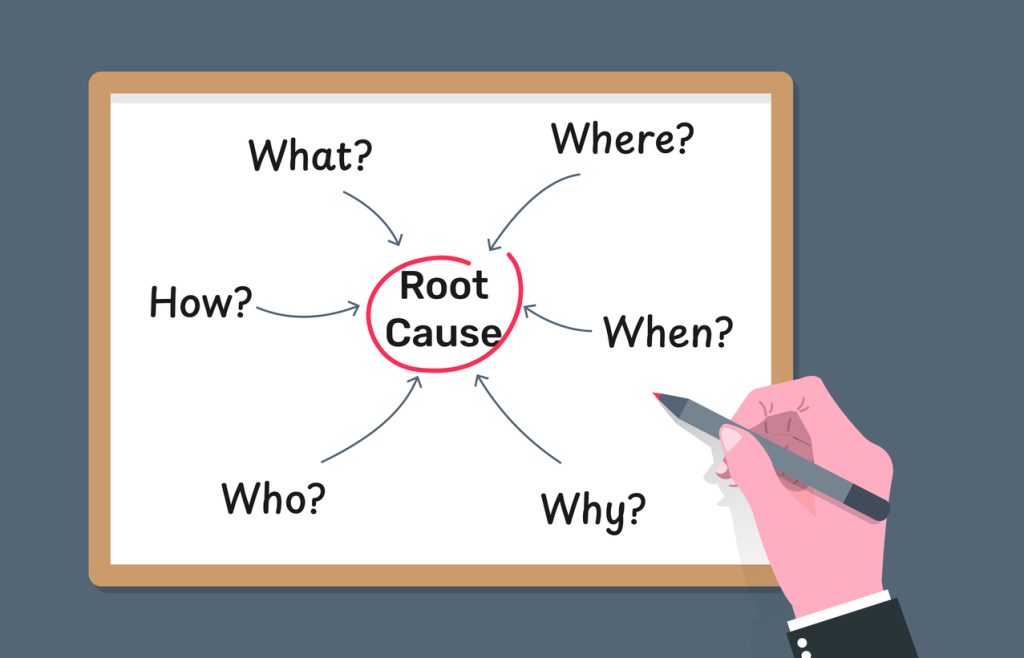

The Questions That Matter: How to Uncover and Overcome Business Roadblocks

Every business reaches a point where growth slows, profitability dips, or the team feels stretched to its limits. While these challenges are common, they’re often symptoms of deeper underlying issues that require a strategic and collaborative approach to resolve.

Read more

OBJ and GGFL Call on Ottawa Businesses to Showcase Their Success

GGFL is excited to be partnering with the Ottawa Business Journal again this year to present the 2025 Fastest Growing Companies awards. This annual initiative recognizes private companies in the National Capital Region that have demonstrated substantial, sustainable,

Read more