There is one simple, but important step business owners can take to help make their filing and on-going interactions with CRA easier and more efficient. With just a few steps, you can authorize GGFL to speak with CRA on your behalf and provide us with access to your CRA My Business account online. If you have not already provided GGFL with this authorization, please review the steps below as soon as possible so that your My Business account is set-up and authorized by the time tax season gets well and truly underway.

Benefits of Authorization

There are many advantages to granting GGFL access to your My Business account. Most importantly, it will allow us to speak with CRA on your behalf whenever necessary. It will also let us view your tax account information to ensure it is accurate and up to date, review any tax assessments you receive and move any payments incorrectly assigned to the incorrect tax account. In short, it lets us keep your tax affairs in order and avoid potential problems down the road.

For full details of what an authorized representative can and cannot do on your behalf, visit the ‘authorize a representative: overview’ page on the Canada.ca website.

Setting up your My Business account and granting us access is easy, but can take a few weeks to complete. Below are the steps to take.

Step 1 – Create Your My Business Account

If you do not already have one, you must create a My Business account. Keep in mind that registration may take several days to allow for authentication. So it is vital that you sign-up well before you, or GGFL, need access to the account. Click below to check out a helpful video with step-by-step instructions on how to get started.

Step 2

Once logged in to your CRA My Account, go to the top right-hand corner and select profile.

Step 3

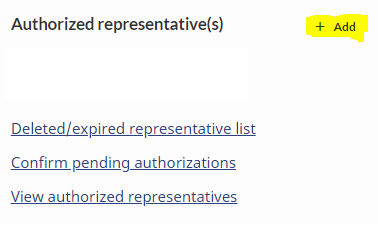

Once you are in your profile select ‘authorized representative(s) and ‘add representative.’

Step 4

Enter GGFL’s representative information:

- RepID, Group IS or BN: 114376288

- Name: GGFL LLP

- BN: 114376288

- Telephone: 613-728-5831

- Fax: Is this required: Leave blank

- Authorization level: Select Level 2

- Online access: Yes

- Expiry date: Select ‘does not expire’

- List of authorizations: All program accounts

Step 5

Click CONFIRM

For More Information

For more instructions on how to authorize a representative, visit ‘authorize a representative: how to give authorization’ on the Canada.ca website.

CRA recommends that you enable email notifications to make sure you are notified when you receive the authorization request. The notifications will also let you know when you have any mail to view in your My Business account, and when important changes have been made on your account.

Authorizing GGFL’s digital access to your My Business account is safe and secure, will help protect your tax information and make our work with CRA on your behalf more efficient. CRA will also stop sending statements and assessments via the post – but not to worry – you can simply log in and print paper copies from your My Business Account!