People go into business to sell either a product or a specialized service.

What they don’t do, is go into business to become debt collectors – unless, of course, they are in the business of debt collecting.

Nobody enjoys the collecting part of business and most business people aren’t necessarily good at it.

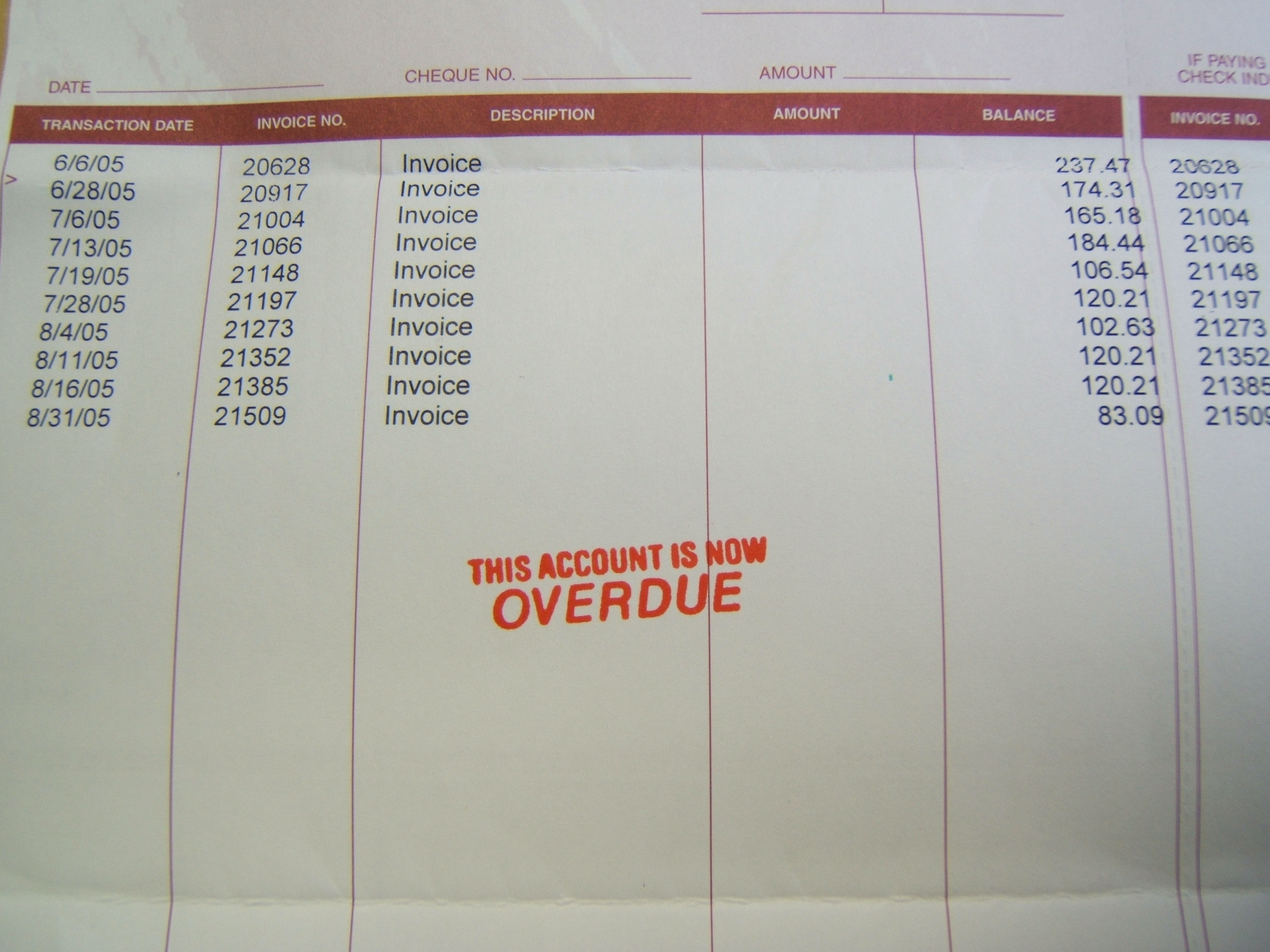

But ignoring the problem will only make matters worse, especially if your business sector, or the overall economy, are experiencing a slowdown. Even a small change in the time it takes to collect your accounts receivable can have a significant impact on your cash flow.

Beware of the customer who usually pays on time but for reasons unknown suddenly has to be hassled for money.

If you’re following up with the customer and still not getting paid, you might be faced with a client who is in financial difficulty.

So avoid making matters worse by thinking ‘oh, it’s alright, they always pay us’ and doing more work for them before they have paid the outstanding invoice.

Statistics show that if a bill hasn’t been paid within 150 days, the chances of it being paid at all are significantly reduced.

When you have accounts receivable, you’re actually financing your client’s business although that aspect doesn’t occur to many business owners.

So what to do to ensure you get paid on time?

Here are some tips on how best to collect on accounts receivable while still being nice about it.

- Negotiate – Offer incentives – perhaps a discount – in exchange for early payment.

- Retainers & Payments – Have a pre-set payment installment schedule and/or a down payment before you start work on a contract. Don’t agree to do all the work before you get paid.

- Charge Interest – Slow payers can often be speeded up if there is a threat of interest charges on late payments. This especially applies to regular customers who are also regularly late paying bills.

- Follow Up – Stay on top of accounts. Invoices can often get lost in a system, or through an email glitch. So regular monitoring of accounts is important. Don’t be afraid to reach out and say, ‘we sent you an invoice, did you receive it?’ They might be slow payers after all.

- Formalize Process – Along with a formal re-payment process, consider setting up an auto reminder to save yourself the awkward ‘I wonder if you might pay my bill’ conversation.

And finally, if you are doing work before receiving a penny from the customer or client, you are also likely paying interest on your own money – money that is financing the contract.

So when it comes to accounts receivable, it makes sense to have a mutually understood – and agreed to – payment system in place.