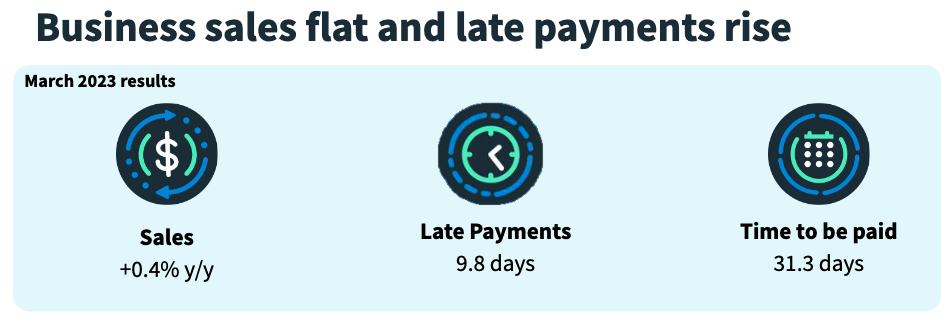

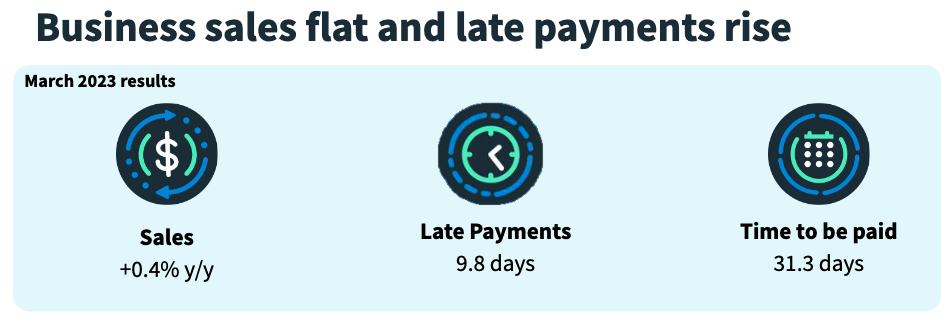

While talk of a recession in Canada has waned in recent months, many small and mid-sized businesses are experiencing increasingly challenging economic conditions. In its most recent report on the state of the small business economy in Canada, accounting software company Xero found that sales for small businesses slowed to just 0.4% in March of 2023, compared to 7.3% between June and September 2022. When considering the effects of inflation, most small businesses experiencing any increase in sales can likely attribute it to rising prices rather than selling more good or services.

To make matters more difficult, the Xero data also shows that payment times to small businesses has been steadily increasing since early 2021. The latest data found that it takes on average 31.3 days for a small business to be paid and that invoices are paid on average 9.8 days late. That is the equivalent of almost two full working weeks and an increase in the potential that businesses are carrying additional cost to “finance” these receivables.

businesses are increasingly being paid late and that sales are barely growing.

As a result of slowing sales and longer wait times for payment, many businesses are facing increased pressure on cashflow. If cashflow is, or can be expected to be tight, a careful review of overhead costs should be considered as part of effective cash flow management.

Overhead costs are a fact of business life and unless they are properly monitored and controlled, they can also quietly eat away at the bottom line.

Focusing on profit margins is a given in business. ‘Profits’ may look healthy, but how much of that hard-earned profit is servicing the office, its furniture, its equipment and staff?

Here’s the danger:

A business is doing well and as the business owner you are confident the climb will continue. You decide to expand the rented office space, lease the latest equipment and hire more employees. Need to go to an annual conference or meet clients and customers in some exotic location? No problem.

This can begin to feel comfortable and even necessary. If the upward trend continues and the business constantly exceeds expectations then it very well may be. BUT what happens when it doesn’t?

The upward trend will inevitably end and either level out or maybe even dip.

But irrespective of the trend, the extra staff occupying that fabulous office space, and surrounded by the latest equipment, will continue to cost the business money. And those costs can easily creep up while a business has been thriving. It isn’t obvious if you are only monitoring the profit margin.

How you cope depends to an extent on the type of business you’re in, but when fixed costs show signs of being a drag on the company’s bottom line, it’s time to ask yourself some tough questions.

- Do I really need all that office space?

- Can I reduce staff without sacrificing the quality of our products or customer service?

- Is it possible to re-negotiate leases or other fixed contracts?

- Can I make even several smaller changes, perhaps to eliminate waste in a process? Small changes can have big impacts.

- How much value are those advertising dollars and entertainment expenses bringing to the business? Find a way to measure it.

- And that conference or out-of-town customer/client business meeting. Could a video-conferencing platform work just as well?

When it comes to managing costs to improve cash flow, many business owners tend to think short term but it is the longer term strategy that is key to keeping a business robust and able to cope with an economic downturn or, even worse, a recession.

An important part of that longer-term strategy is keeping a close watch on those fixed costs, however small they might be.

Contact your advisor for help on reviewing your operations and financial information to ensure your business is ready and resilient.