All Ontario corporations are legally required to have audited financial statements. If your company is privately owned, and the shareholders unanimously agree in writing each year, the business can forgo an audit engagement.

There are three types of reports that can accompany corporate financial statements: Notice to Reader, Review Engagement, and Audited Financial Statements which include an Auditor’s Report. To determine the appropriate level of assurance service for your business, it is important to understand who will be viewing the financial reports and what level of independent assurance they require. Are you seeking bank loans? Are you planning to sell the business? Are there shareholders who do not take an active role in the business?

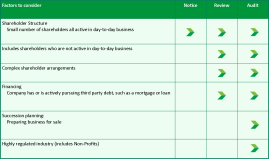

Which service is appropriate for my business this year?

A Notice to Reader is appropriate where the business owner monitors all financial transactions, and is the only user of financial reports. This generally means there is no third-party debt such as a bank loan or mortgage.

A Review Engagement Report is appropriate where there are shareholders who are not involved in the day-to-day business, the business is preparing for sale, or the business has or is looking for financing.

An Auditor’s Report is appropriate where there are complexities in the corporation’s ownership structure, financing arrangements or regulated industries.

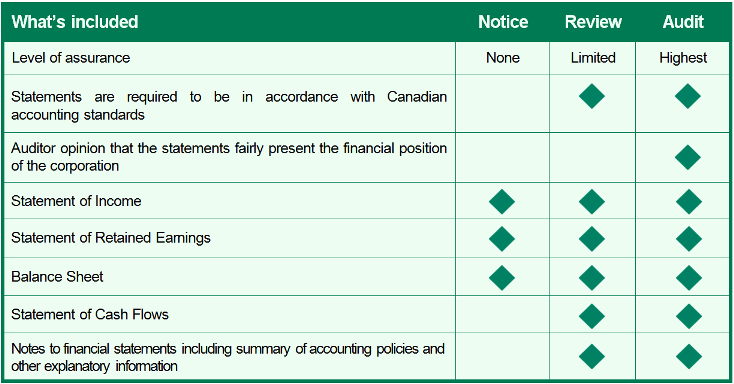

What does each level of assurance entail?

A Notice to Reader, also referred to as a Compilation Engagement, is prepared when we compile the financial statements based on the information provided. These financial statements are intended for management’s eyes only. The Notice clearly indicates that the accountant provides no assurance as to the fairness of the financial information reported or whether the statements are in accordance with Canadian accounting standards. A Notice to Reader would include this statement:

We have not performed an audit or a review engagement in respect of these financial statements and, accordingly, we express no assurance thereon. Readers are cautioned that these statements may not be appropriate for their purposes.

A Review Engagement Report offers limited assurance. We determine the financial statements’ plausibility through enquiry, analysis, and discussions related to the information provided. Our report based on this work states:

Based on our review, nothing has come to our attention that causes us to believe that these financial statements are not, in all material respects, in accordance with Canadian accounting standards for private enterprises.

The Auditor’s Report is the most thorough level of engagement. As such, the Audit Engagement allows us to provide the highest level of assurance to the users. We would gain an understanding of their system of internal controls and perform substantive testing, in addition to performing all procedures from the Review Engagement. The thoroughness of the Audit Engagement allows us to issue the Auditor’s Opinion, which states:

In our opinion, the financial statements present fairly, in all material respects, the financial position of ABC Company Inc., as at (year-end date), and the results of its operations and its cash flows for the year then ended in accordance with Canadian accounting standards for private enterprises.

Speak to an advisor

As you can see, there are many factors to consider in selecting the appropriate level of assurance. Our advisors would be happy to speak with you about the right choice for your company.