On Tuesday, February 27th, Finance Minister Bill Morneau released the 2018 Federal Budget. As with every budget, GGFL’s main focus is on how our clients and their businesses will be impacted.

To that end, we have chosen the top six budget highlights that we feel will have the greatest impact on you in 2018.

Budget Highlights

- The budget is proposing two new measures related to passive investments income, effective for taxation years beginning after 2018:

- Opportunities to benefit from the small business tax rate are reduced for Canadian controlled private corporations (CCPCs) and their associated corporations, that have more than $50,000 of investment income, and NIL if the investment income is over $150,000.

- Limitation on refundable taxes by the corporation of certain dividends; a new Refundable Dividend Tax on Hand (RDTOH) account will be created to track the Part IV tax (refer to your accountant for more details to see if this applies to you).

- The budget introduces new reporting obligations for trusts, effective for tax returns filed for the 2021 and subsequent taxation years.

- The Federal Government reiterated that they will go forward with the draft proposal on Tax on Split Income (TOSI), effective January 1, 2018. No additional details were given since the last release in December 2017.

- There are no further changes in tax brackets or income tax rates for individuals.

- The Federal Government also states that they will lower the Federal portion of the small business tax rate to 10%, effective January 1, 2018, and to 9%, effective January 1, 2019.

- The budget expects a deficit of $19.4 billion for fiscal 2017-2018, and $18.1 billion for 2018-2019.

While the above are our top picks for what points are most relevant to our clients, we’ve included additional changes below for your reference.

If you have any questions about the 2018 Federal Budget, please contact your accountant.

A. Business Income Tax

Passive Income

Since Budget 2017 first expressed an intention to reduce the tax benefits of accumulating passive assets in a Canadian-controlled Private Corporation (CCPC), private business owners and their advisors have been faced with a series of proposals and comments on the taxation of passive income.

Budget 2018 includes details of a new passive investment tax regime for CCPCs, proposed to apply to taxation years commencing after 2018. Two significant changes are proposed, first a limit in access to the small business deduction for CCPCs generating significant income from passive assets, and second, a new regime to stream the recovery of refundable tax to the payment of specific types of dividends (eligible versus non-eligible).

Access to the Small Business Deduction (SBD)

The first prong of the passive income proposals will reduce access to the SBD for CCPCs having more than $50,000 of passive income. This is consistent with the Government’s October, 2017 announcement that the first $50,000 of passive income would be exempt from any new rules.

CCPCs with passive income in excess of $50,000 will lose $5 of business limit for every $1 of additional passive income, such that the entire business limit will be eliminated for CCPCs having $150,000 or more passive income in the year.

Some CCPCs already have a reduced business limit due to high taxable capital. The greater of that reduction and the new reduction for passive income will apply.

Consistent with the existing SBD rules, passive income of all associated corporations will apply to determine the reduced business limit available to the associated group. The prior year’s passive income will determine the current year’s SBD limit.

What is “Passive Income”?

Certain types of income considered “passive” are subject to different corporate tax rules. Common forms of income subject to existing “passive income” rules include interest, rental income, royalties, dividends from portfolio investments and taxable capital gains.

Various exceptions presently apply, and will also apply to these new rules. For example, income incidental to an active business is excluded. As well, income which would otherwise be considered passive which is received from an associated corporation generally retains its character as active income. A common example of this exception is rent paid from a corporation carrying on an active business to an associated corporation which owns the business real estate.

For purposes of these new rules, capital gains on certain types of property will also be excluded. These are as follows:

- Capital gains realized on the disposition of property used principally in an active business carried on in Canada. The active business could be carried on by the owner of the asset, or by a related party. Examples of gains which will not count towards passive income under this exception include gains on sale of the goodwill of an active business, and gains on the real estate from which the active business operates.

- Capital gains realized on shares of another CCPC all or substantially all of whose assets are used in an active business carried on in Canada will generally be excluded, provided the seller has a significant interest (generally over 10%) in that corporation.

- Similarly, capital gains realized on an interest in a partnership all or substantially all of whose assets are used in an active business carried on in Canada will generally be excluded where the seller has a significant interest (generally over 10%) in the partnership.

Where capital losses realized in a different taxation year are applied to offset capital gains realized in the current year, these losses will not reduce passive income for these new rules.

Recovering Refundable Taxes

Passive income is subject to a high corporate tax rate. However, a portion of these taxes are refunded when the CCPC pays taxable dividends. The Government had previously suggested eliminating the refundability of this tax. That suggestion has been abandoned.

However, the second prong of the passive income proposals will add a new restriction. Recovering refundable taxes will generally require the payment of non-eligible dividends. These carry a higher personal tax cost than eligible dividends.

The exception will be refundable taxes arising from eligible dividends received. Most public corporations pay eligible dividends. This refundable tax will continue to be recoverable by paying any type of dividends, including eligible dividends.

Additional Complexities

The proposals also include anti-avoidance measures.

While these new rules will generally apply only to taxation years commencing after 2018, they will apply earlier where planning transactions are undertaken to delay their application.

As well, transfers of passive assets between related corporations may result in the transferor and transferee corporations being required to combine their passive income for the purposes of the reduction to their SBD limits. This provision could apply, for example, if a corporation transfers investment assets to a second corporation owned by the spouse or children of the owner of the first corporation.

Clean Energy Generation Equipment

A variety of assets related to clean energy generation and energy conservation qualify for accelerated capital cost allowance at rates of either 30% (Class 43.1) or 50% (Class 43.2). Access to the 50% rate is currently available only for assets acquired before 2020. Budget 2018 proposes to extend this to assets acquired before 2025 (so on or before December 31, 2024).

Anti-Avoidance Provisions

Budget 2018 proposes enhancements to several anti-avoidance rules related to complex structures and transactions. A brief summary of the types of transactions affected is provided below.

Equity-Based Financial Arrangements

A variety of complex anti-avoidance provisions apply to deny the normal tax-free status of intercorporate dividends in circumstances perceived as abusive by the Department of Finance. Budget 2018 enhances existing anti-avoidance rules related to the following:

- Synthetic equity arrangements, where a tax-indifferent investor obtains the risk of loss and opportunity for gain or profit in respect of Canadian shares without an actual transfer of the shares resulting in a taxable disposition to the original owner.

- Securities lending arrangements, where a Canadian share is transferred or loaned to a taxpayer, and the taxpayer agrees to transfer or return an identical share in the future. Over the term of the arrangement, the taxpayer is obligated to pay “dividend compensation payments” for all dividends received on the transferred or lent Canadian share, which they deduct against other sources of income.

Tiered Limited Partnerships

A recent court decision suggested it may be possible for the ultimate partners to avoid the “at-risk” rules by using such structures. Budget 2018 proposes to extend the at-risk rules to partnerships which are limited partners in other partnerships (“tiered limited partnerships”).

Health and Welfare Trusts – Consultation

Health and Welfare Trusts (HWTs) are not presently governed by income tax legislation. However, CRA has an extensive series of administration policies under which these Trusts are treated differently from a typical trust. In contrast, Employee Life and Health Trusts (ELHTs) are the subject of specific tax legislation. Both types of Trust provide similar benefits to employees of one or more organizations which fund the Trust.

While the ELHT rules are similar to CRA’s administrative positions on HWTs, they are not identical. Budget 2018 proposes that CRA will cease to apply their HWT administrative positions after 2020. Existing HWTs will either transition to ELHTs under transitional rules, or will become subject to the normal income tax rules for trusts after 2020.

HWTs established after Budget Day will be ineligible for CRA’s administrative positions from their creation, so they must either be structured as ELHTs or be subject to the normal rules for Trusts.

Stakeholders are invited to submit comments on transitional issues, both administrative and legislative, after which the Government intends to release draft legislative proposals and transitional administrative guidance.

Comments are requested by June 29, 2018 to HWT-consultation-FSBE@canada.ca.

B. Personal Income Tax

Canada Workers Benefit

Budget 2018 proposes to rename the Working Income Tax Benefit to the Canada Workers Benefit. The amount of the benefit will be equal to 26 percent of each dollar of earned income in excess of $3,000 to a maximum benefit of $1,355 for single individuals without dependants and $2,335 for families (couples and single parents). These amounts are increased from the prior maximum amounts of $1,192 and $2,165, respectively.

The Benefit will be reduced by 12 percent of adjusted net income in excess of $12,820 for single individuals without dependants and $17,025 for families. Previously, the reduction rate was 14 percent. Each province may arrange variances from these amounts.

Ability to access the Benefit for those that have filed returns, but not claimed the Benefit, will also be improved.

This measure will apply to the 2019 and subsequent taxation years. Indexation of amounts relating to the Canada Workers Benefit will continue to apply after the 2019 taxation year.

Medical Expense Tax Credit – Eligible Expenditures

Budget 2018 proposes to expand the medical expense tax credit to recognize such expenses where they are incurred in respect of an animal specially trained to perform tasks for a patient with a severe mental impairment in order to assist them in coping with their impairment (e.g., a psychiatric service dog trained to assist with post-traumatic stress disorder).

For example, these tasks may include guiding a disoriented patient, searching the home of a patient with severe anxiety before they enter and applying compression to a patient experiencing night terrors. Expenses will not be eligible if they are in respect of an animal that provides comfort or emotional support but that has not been specially trained to perform tasks as described above.

This measure will apply in respect of eligible expenses incurred after 2017.

Registered Disability Savings Plan (RDSP) – Qualifying Plan Holders

Where the adult individual does not have a legal representative in place, a temporary federal measure exists to allow a qualifying family member (i.e., a parent, spouse or common-law partner) to be the plan holder of the individual’s RDSP.

Previously legislated to expire at the end of 2018, Budget 2018 proposes to extend the temporary measure by five years, to the end of 2023. A qualifying family member who becomes a plan holder before the end of 2023 could remain the plan holder after 2023.

Mineral Exploration Tax Credit for Flow-Through Investors

The Government proposes to extend eligibility for the mineral exploration tax credit for an additional year, to flow-through share agreements entered into on or before March 31, 2019. Under the existing “look-back” rule, funds raised in one calendar year with the benefit of the credit can be spent on eligible exploration up to the end of the following calendar year. Therefore, for example, funds raised with the credit during the first three months of 2019 can support eligible exploration until the end of 2020.

Employee Contributions to the Quebec Pension Plan

To provide consistent income tax treatment of CPP and QPP contributions, Budget 2018 proposes to amend the Income Tax Act to provide a deduction for employee contributions (as well as the “employee” share of contributions made by self-employed persons) to the enhanced portion of the QPP. In this regard, the Government of Quebec announced on November 21, 2017 that the enhanced portion of employee CPP and QPP contributions will be deductible for Quebec income tax purposes.

Since contributions to the enhanced portion of the QPP will begin to be phased in starting in 2019, this measure will apply to the 2019 and subsequent taxation years.

Child Benefits – Foreign Born Status Indians

Under the Canada Child Benefit, as announced in Budget 2016, foreign-born status Indians residing legally in Canada who are neither Canadian citizens nor permanent residents are eligible for the Benefit, where all other eligibility requirements are met. However, these individuals were not eligible under the previous system of child benefits.

Budget 2018 proposes that such individuals be made retroactively eligible for the Canada Child Tax Benefit, the National Child Benefit supplement and the Universal Child Care Benefit, where all other eligibility requirements are met.

This amendment applies from the 2005 taxation year to June 30, 2016.

C. International Tax

Cross-Border Surplus Stripping Using Partnerships and Trusts

The current cross-border surplus stripping rules are designed to prevent a non-resident shareholder from extracting amounts from a Canadian corporation in excess of the paid-up capital (this is generally the amount invested in the corporation) without being taxed on a dividend. In order to capture transactions using partnerships and trusts that are designed to achieve the same outcome, Budget 2018 proposes to implement a series of “look-through” rules for transactions that occur on or after Budget Day. These look-through rules will allocate the assets, liabilities and transactions of a partnership or trust to its members or beneficiaries, as the case may be, based on the relative fair market value of their interests.

Foreign Affiliates

The Income Tax Act contains special rules for the taxation of Canadian resident shareholders of controlled foreign affiliates. Shareholders are generally taxed on their share of corporately retained passive earnings. In some situations, taxpayers may pool their investment assets in one corporation in order to avoid this tax. Commonly, they would track their specific assets held within the corporation separately (a tracking arrangement).

Control Test

Often these arrangements are set up to avoid meeting the definition of controlled foreign affiliate. Budget 2018 proposes to deem such a corporation to be a controlled foreign affiliate of the taxpayer where such a tracking arrangement exists.

Employee Test

Another reason that such a corporation may be set up is to meet the exception for businesses with more than five full-time employees.

Budget 2018 proposes to deem such a corporation to have separate businesses where tracking arrangements exist. As such, more than five employees would be required for each business in order to meet the exception.

These measures will apply to taxation years of a taxpayer’s foreign affiliate that begin on or after Budget Day.

Filing Due Dates

Budget 2018 proposes to bring the information return deadline in respect of a taxpayer’s foreign affiliates in line with the taxpayer’s income tax return deadline by requiring the information returns to be filed within six months after the end of the taxpayer’s taxation year. This will accelerate the deadline for filing Form T1134 from its current due date, fifteen months after year end.

In order to give taxpayers time to adjust to this change, the measure will apply to taxation years of a taxpayer that begin after 2019.

Also, the reassessment period for tax matters related to foreign affiliates will be extended by three years (generally a total of six years for individuals and CCPCs).

D. Sales and Excise Tax

GST/HST and Investment Limited Partnerships

Budget 2018 proposes that GST/HST apply to management and administrative services rendered by the general partner to an investment limited partnership on or after September 8, 2017, unless the general partner charged GST/HST in respect of such services before that date. This clarifies proposals originally released on September 8, 2017.

Second, Budget 2018 proposes that the GST/HST be generally payable on the fair market value of management and administrative services in the period in which these services are rendered.

Finally, Budget 2018 proposes to allow an investment limited partnership to make an election to advance the application of the special HST rules as of January 1, 2018.

GST/HST Holding Corporation Rules – Consultation

A Goods and Services Tax/Harmonized Sales Tax (GST/HST) rule, commonly referred to as the “holding corporation rule”, generally allows a parent corporation to claim input tax credits to recover GST/HST paid in respect of expenses that relate to another corporation. This rule provides that, where a parent corporation resident in Canada incurs expenses that can reasonably be regarded as being in relation to shares or indebtedness of a commercial operating corporation (a corporation all or substantially all of the property of which is for consumption, use or supply in commercial activities) and the parent corporation is related to the commercial operating corporation, the expenses are generally deemed to have been incurred in relation to commercial activities of the parent corporation.

The Government intends to consult on certain aspects of the holding corporation rule, particularly with respect to the limitation of the rule to corporations and the required degree of relationship between the parent corporation and the commercial operating corporation. At the same time, the Government intends to clarify which expenses of the parent corporation that are in respect of shares or indebtedness of a related commercial operating corporation qualify for input tax credits under the rule.

Budget 2018 indicates that consultation documents and draft legislative proposals regarding these issues will be released for public comment in the near future.

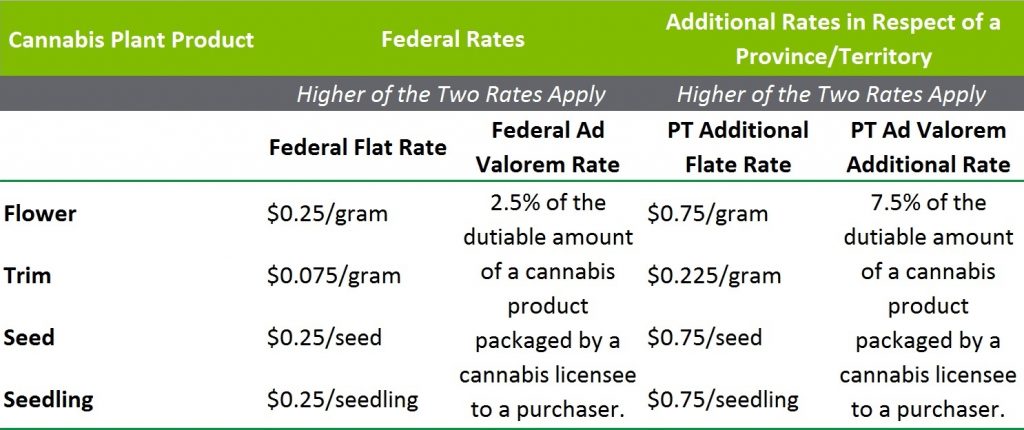

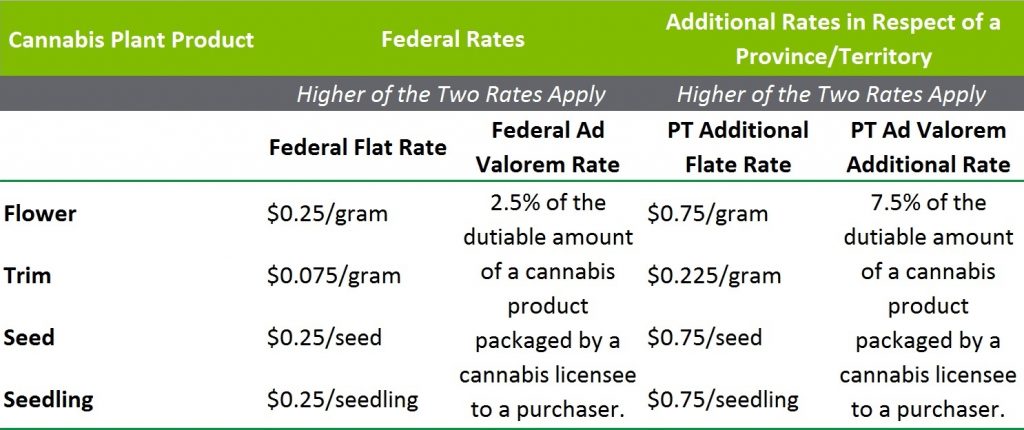

Cannabis Taxation

Budget 2018 proposes a new federal excise duty framework for cannabis products to be introduced as part of the Excise Act, 2001. The duty will generally apply to all products available for legal purchase, which at the outset of legalization will include fresh and dried cannabis, cannabis oils, and seeds and seedlings for home cultivation.

Cannabis cultivators and manufacturers will be required to obtain a cannabis licence from the CRA and remit the excise duty, where applicable. The framework will come into effect when cannabis for non-medical purposes becomes available for legal retail sale.

The Goods and Services Tax/Harmonized Sales Tax (GST/HST) basic groceries rules of the Excise Tax Act will be amended to ensure that any sales of cannabis products that would otherwise be considered as basic groceries are subject to the GST/HST in the same way as sales of other types of cannabis products.

Excise Duty Rates for Cannabis Products

E. Other Measures

Sharing Tax Information Relating to Serious Non-Tax Offences

Budget 2018 proposes to enable the sharing of tax information with Canada’s mutual legal assistance partners in respect of acts that, if committed in Canada, would constitute terrorism, organized crime, money laundering, criminal proceeds or designated substance offences (i.e., offences listed in section 462.48 of the Criminal Code).

A similar issue relates to the authority of the Attorney General to apply for a court order to allow Canadian police officers to obtain taxpayer information under the Income Tax Act for an investigation or prosecution of those offences. Currently, there is no ability to obtain similar confidential information under Part IX of the Excise Tax Act or the Excise Act, 2001.

To address this inconsistency, Budget 2018 also proposes to enable confidential information under Part IX of the Excise Tax Act and the Excise Act, 2001 to be disclosed to Canadian police officers in respect of those offences where such disclosure is currently permitted in respect of taxpayer information under the Income Tax Act.

Charities – Technical Issues

Transfers to Municipalities on Revocation of Registration

The registration of a charity may be revoked at the request of the charity or because the charity has not complied with its registration requirements. In such cases, a 100 percent revocation tax on the charity based on the total net value of its assets is applicable. The charity can reduce the amount of revocation tax by making qualifying expenditures, including gifts to “eligible donees”.

Budget 2018 proposes to amend the Income Tax Act to allow transfers of property to municipalities to be considered qualifying expenditures for the purposes of the revocation tax, subject to the approval of the Minister of National Revenue on a case-by-case basis.

Universities Outside Canada

The donation tax credit or deduction may be available for donations made to universities outside Canada if they demonstrate to CRA that, among other things, their student body ordinarily includes students from Canada.

In 2011, the Income Tax Act was amended so that certain categories of qualified donees, including universities outside Canada, were required to register with CRA, and to meet certain receipting and record-keeping conditions.

To simplify the administration of these rules and streamline the registration process for universities outside Canada as qualified donees, Budget 2018 proposes to remove the requirement that universities outside Canada be prescribed in the Income Tax Regulations.

This measure will apply as of Budget Day.

Trusts – Beneficial Ownership and Control

Affected Trusts

To improve the collection of beneficial ownership information with respect to trusts, Budget 2018 proposes to require that certain trusts provide additional information on an annual basis. The new reporting requirements will impose an obligation on certain trusts to file a T3 return where one does not currently exist.

The new reporting requirements will apply to express trusts that are resident in Canada. They will also apply to non-resident trusts that are currently required to file a T3 return.

An express trust is generally a trust created with the settlor’s express intent, usually made in writing (as opposed to a resulting or constructive trust, or certain trusts deemed to arise under the provisions of a statute).

Exceptions to the additional reporting requirements are proposed for the following types of trusts:

- Mutual fund trusts, segregated funds and master trusts;

- Trusts governed by registered plans (i.e., deferred profit sharing plans, pooled registered pension plans, registered disability savings plans, registered education savings plans, registered pension plans, registered retirement income funds, registered retirement savings plans, registered supplementary unemployment benefit plans and tax-free savings accounts);

- Lawyers’ general trust accounts;

- Graduated rate estates and qualified disability trusts;

- Trusts that qualify as non-profit organizations or registered charities; and

- Trusts that have been in existence for less than three months or that hold less than $50,000 in assets throughout the taxation year (provided, in the latter case, that their holdings are confined to deposits, government debt obligations and listed securities).

Required Disclosure

Unless one of these exceptions is met, trusts will now be required to report the identity of all trustees, beneficiaries and settlors of the trust, as well as the identity of each person who has the ability (through the trust terms or a related agreement) to exert control over trustee decisions regarding the appointment of income or capital of the trust (e.g., a protector).

These proposed new reporting requirements will apply to returns required to be filed for the 2021 and subsequent taxation years.

Penalties

Budget 2018 also proposes to introduce new penalties for a failure to file a T3 return, including a required beneficial ownership schedule, in circumstances where the schedule is required. The penalty will be equal to $25 for each day of delinquency, with a minimum penalty of $100 and a maximum penalty of $2,500.

If a failure to file the return was made knowingly, or due to gross negligence, an additional penalty will apply. The additional penalty will be equal to five percent of the maximum fair market value of property held during the relevant year by the trust, with a minimum penalty of $2,500. As well, existing penalties will continue to apply.

The new penalties will apply in respect of returns required to be filed for the 2021 and subsequent taxation years.

Employment Insurance (EI)

Parental Sharing Benefit

Budget 2018 proposes an increase to the duration of EI parental leave by up to five weeks in cases where the second parent agrees to take a minimum of five weeks of the maximum combined 40 weeks available using the standard parental option of 55 percent of earnings for 12 months. In other words, as long as each parent takes at least 5 weeks, the couple will qualify for a total of 40 weeks (35 weeks otherwise).

Alternatively, where families have opted for extended parental leave at 33 percent of earnings for 18 months, the second parent would be able to take up to eight weeks of additional parental leave. In cases where the second parent opts not to take the additional weeks of benefits, standard leave durations (35 weeks and 61 weeks) will apply.

The proposed benefit will be available to eligible two-parent families, including adoptive and same-sex couples, to take at any point following the arrival of their child. The benefit is expected to commence in June of 2019.

Working While on Claim

Budget 2018 proposes to make the current EI Working While on Claim pilot rules permanent. The EI Working While on Claim pilot project allows claimants to keep 50 cents of their EI benefits for every dollar they earn, up to a maximum of 90 percent of the weekly insurable earnings used to calculate their EI benefit amount. These provisions were previously scheduled to expire in August 2018.

Extension of Reassessment Period

In recent months, CRA has issued numerous requirements for information from third parties. Examples include PayPal’s disclosure of business accounts, contractor accounts at Rona, and many condominium developers being required to provide details of pre-sold units changing ownership before the unit is acquired. Often, these demands for information are challenged before the Courts.

Budget 2018 proposes to “stop the clock” on the usual reassessment deadline where these requirements are contested. A similar rule will apply to compliance orders issued by the Courts where the actual taxpayer contests requirements to provide information to CRA.

If CRA issues a requirement for information, and it is contested, the period from filing court papers to the final decision of the Courts (including any appeals) will not count towards the usual time limit for CRA to reassess any taxpayer affected by the information disclosed.

These new rules will apply where information requirements are challenged after these proposals receive Royal Assent.

F. Previously Announced Measures

Previously Announced Measures

Budget 2018 confirms the Government’s intention to proceed with the following previously announced tax and related measures, as modified to take into account consultations and deliberations since their release:

- Income tax measures released on December 13, 2017 to address income sprinkling;

- Measures confirmed in Budget 2016 relating to the Goods and Services Tax/Harmonized Sales Tax joint venture election;

- Income tax measures announced in Budget 2016 expanding tax support for electrical vehicle charging stations and electrical energy storage equipment;

- The income tax measure announced in Budget 2016 on information reporting requirements for certain dispositions of an interest in a life insurance policy;

- Technical income tax legislative amendments released on September 16, 2016, relating to a division of a corporation under foreign laws, and to the requirements to qualify as a prescribed share;

- The income tax measure announced in Budget 2017 to support the establishment of a tax-exempt Memorial Grant for First Responders (the Community Heroes benefit);

- The income tax measure announced on May 18, 2017 for additional tax relief for Canadian armed forces personnel and police officers;

- Remaining legislative and regulatory proposals released on September 8, 2017 relating to the Goods and Services Tax/Harmonized Sales Tax;

- The income tax measure announced on October 16, 2017 to lower the small business tax rate from 10.5 percent to 10 percent, effective January 1, 2018, and to 9 percent, effective January 1, 2019, which was included in a Notice of Ways and Means Motion tabled on October 24, 2017 along with related amendments to the gross-up amount and dividend tax credit for taxable dividends; and

- The income tax measure announced on October 24, 2017 in the Fall Economic Statement to provide for the indexing of the Canada Child Benefit amounts as of July 1, 2018 instead of July 1, 2020.

Budget 2018 also reaffirms the Government’s commitment to move forward as required with technical amendments to improve the certainty of the tax system.

The information provided in this publication is intended for general purposes only. Care has been taken to ensure the information herein is accurate; however, no representation is made as to the accuracy thereof. The information should not be relied upon to replace specific professional advice.