By: Anne Van Delst

There are few industries more complex and multi-layered than the construction business.

It is a mix of union and non-union, and a mix of new construction, retro-fitting, renovation, residential, commercial and domestic.

It is a business where multiple sub-contractors are invariably onsite at the same time – reliant on each other to get each portion of the work done quickly, efficiently and well. The electrician waits for the framer, the dry waller waits for the electrician, and on it goes.

And crucially, contract deadlines are tight and demanding.

Smaller construction firms often have key employees of long standing who are so skilled and reliable, that bidding for contracts are based on the confidence the employer has in them to get the job done well, and on time.

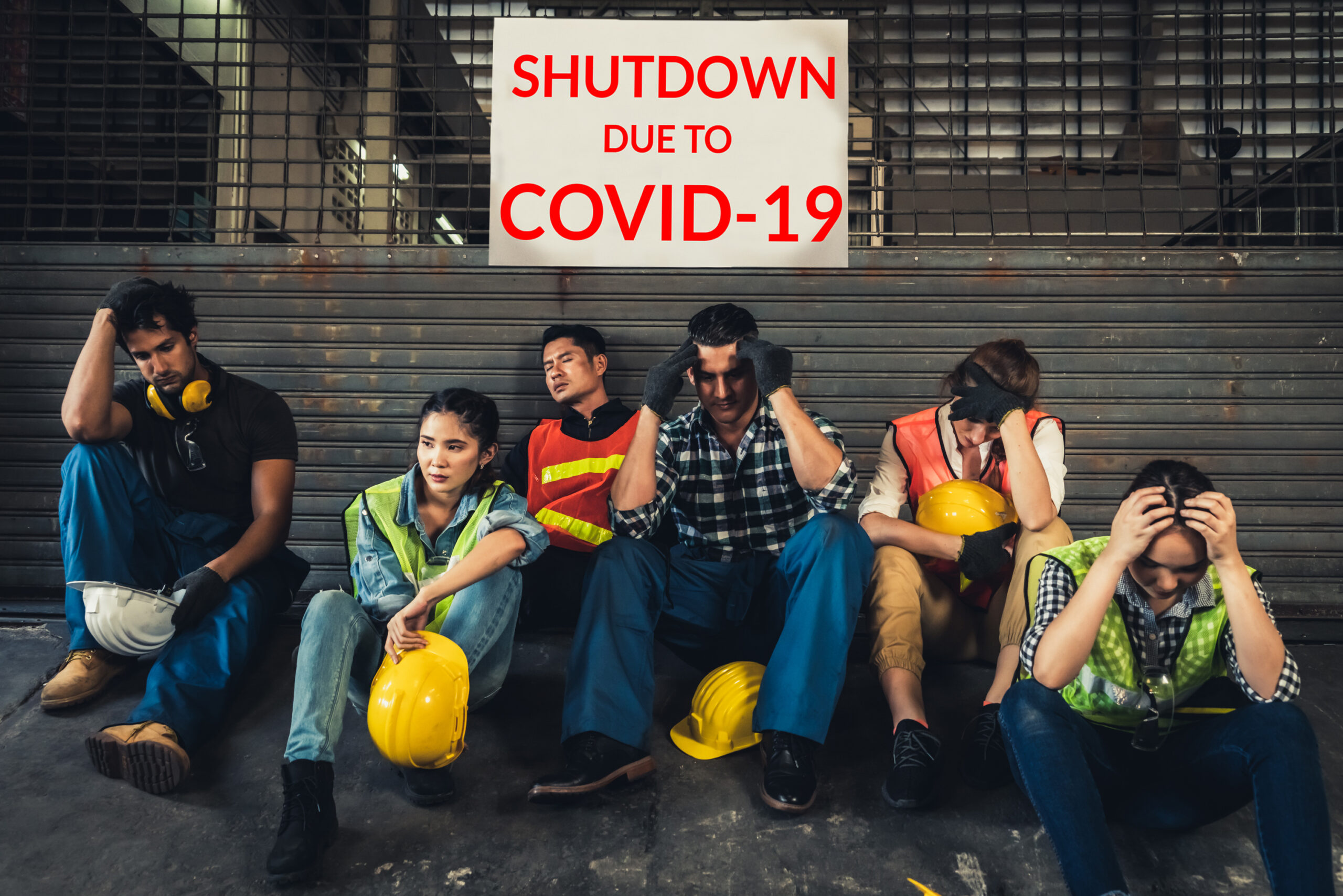

That brief snapshot helps explain why the COVID-19 pandemic, and the deluge of necessary government emergency restrictions and emergency benefits, have brought a mix of disruption, confusion and uncertainty to the construction business.

As my clients in the construction business have been telling me this past week, what was already an uncertain situation became a lot more uncertain following Ontario Premier Doug Ford’s crackdown on the building industry on Friday (April 3).

Owners of unionized sites cannot guarantee getting the same worker back if they lay him or her off because when normal business resumes union rules determine who gets sent to a jobsite. A company can’t guarantee that they will get the same people back, it’s the union that decides. So to lay off, or not to lay off?

Concern about being in close proximity to others has persuaded some construction workers to stay home, and on sites where close proximity is unavoidable, management has been forced to close sites down.

The uncertainty is unlikely to subside until the government offers more clarity on its financial relief measures and how, specifically, they apply to those in the construction business.

There are, of course, exceptions to new provincial government rules that allow some construction sites to continue operating normally – providing they adhere to physical distancing rules.

Work in the health care sector – hospitals, for example; anything related to safety, security or sanitation; residential construction if the footings have been complete are some of exemptions.

But generally commercial construction – renovation of non-government commercial sites etc. – is not exempt.

Some emergency financial measures, such as deferral of the WSIB until August 31, are helpful but many in the construction industry are waiting to see more clarity around the 75 per cent wage subsidy and the $40,000 interest-free business loan.

To qualify, firms have to prove that revenue has dropped significantly due to the impact of COVID-19. (see ‘The Canada Emergency Wage Subsidy).

As we approach the holiday weekend, the medium to larger construction firms are still in good financial shape but owners of the smaller firms are justifiably nervous. If the current situation continues for more than four weeks, some say they will be in trouble.

Along with health and labour issues, their overriding problems relate to cash flow.

Pending more specific construction industry detail from government, my advice generally has been to defer paying what you can – HST, for example – and borrow what you might need, but with the caveat that you will have to repay what you defer and borrow.

In the construction industry there is no one-size-fits-all solution but in the current situation, those financial and labour issues can be complex. So if you own a construction firm, discuss your options with a labour lawyer and your financial advisor.

It’s also worth mentioning that during this COVID-19 crisis, construction workers have donated much-needed masks to workers in the health community. It’s typical of an industry that has a tradition of giving back to the community. When there’s a need, they step up.

Anne Van Delst is a GGFL partner, (Assurance and Advisory Services) with numerous clients in the construction industry.