Why Incorporate?

For those approaching (or beyond) retirement age who hold sizeable non-registered investment portfolios, incorporating investments can be an attractive option. There are a number of potential advantages to holding investments in a company rather than personally. Incorporating creates flexible opportunities to minimize your personal tax liability during your lifetime and at death.

Minimize Taxes Payable on Death

Upon death, an individual is considered, for tax purposes, to have sold all of their assets at market value. Taxes are payable on items such as the full value of their RRSPs/RRIFs, and the net gain on their non-registered investment portfolios and real estate (other than a principal residence). This assessment of tax on RRSPs/RRIFs and net gains occurs on the last to die of a married or common-law couple.

Without proper planning, a significant tax liability can arise on an individual’s death. However, by incorporating non-registered investments during one’s lifetime, these taxes on death can be deferred and may be reduced.

Estate Planning

If an individual plans to give their non-registered investments directly to a family member during their lifetime (other than their spouse), two things will happen: a taxable disposition and a loss of control of those investments.

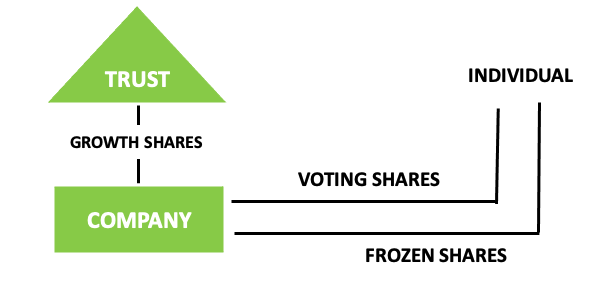

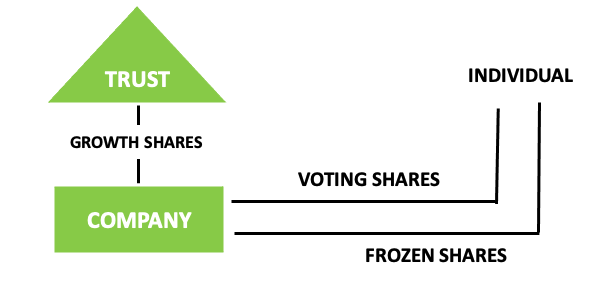

An alternative is to transfer these investments to a company on a tax-deferred basis in exchange for fixed-value shares and a loan receivable from the company, the total of which having equivalent value to the investments transferred. Doing this allows future growth in value of the investments to accrue to other individuals (or to a family trust), who would hold the company growth shares. By redeeming the preferred shares over time, fewer shares will be held on death, which will reduce the ultimate tax liability to an individual’s estate. These share redemptions will result in dividends received over an individual’s lifetime – some of which may be tax-free. The use of corporate-owned life insurance can further reduce the taxes payable on death.

With this scenario, an individual can retain control over the investments by owning the majority of voting shares of the company.

How It Works

Estate Freeze

An estate freeze is one strategy used to maximize a family’s wealth. Typically, this is achieved by:

- Transferring an individual’s non-registered investments into a company in exchange for fixed-value shares and a loan receivable from the company.

- Issuing the growth shares of the company to a trust, for the benefit of both the individual and their family, to participate in any future growth in value.

- The individual can retain voting control over the company.

- Redeeming the fixed-value shares gradually during the individual’s lifetime, to minimize taxes at death.

- Repaying the loan receivable, in the amount of the initial cost of the investments, as a tax-free return of capital to the individual.

Example of an Estate Freeze

Assume an Ontario resident individual’s only income is from investments. The following is an example of the use of a company to hold the investments:

Fair market value of investments $3,000,000

Cost of investments $2,000,000

Unrealized gain $1,000,000

- The annual return on the investment is a 4% dividend, or $120,000 of eligible dividends.

- The individual requires the annual income to pay living expenses.

- Assume that the value of the portfolio will double in 10 years to $6,000,000.

Scenario A – Do Nothing

Each year, the only source of income is $120,000 of eligible dividends. The cash flow is as follows:

Dividend income $ 120,000

Personal income taxes on eligible dividends $ 14,000

Net personal cash after taxes $ 106,000

After 10 years, the unrealized gains would be $4,000,000 ($6,000,000 – $2,000,000). If the individual died, the tax liability of the estate would be approximately $1,030,000, assuming no other taxable assets (such as a RRIF) were owned at the time of death.

Scenario B – Estate Freeze

The tax liability can be reduced and deferred through a typical estate freeze as follows:

- The investments worth $3,000,000 are transferred on a tax-deferred basis to a company. No taxes are payable on the transfer.

- On the transfer, the individual would receive $2,000,000 of a loan receivable from the company and $1,000,000 of fixed-value shares of the company.

- The individual’s adult children (or a family trust) would purchase the growth shares of the company for a nominal amount.

- Each year, the $120,000 earned in the company would be used to redeem $120,000 of the individual’s shares (taxable as a dividend). The personal taxes payable by the individual each year are the same under both options.

- In fewer than 9 years, the individual would no longer hold any fixed-value shares.

- After 10 years, the investments held by the company are worth $6,000,000.

- The individual still holds the loan receivable from the company of $2,000,000 which can be received tax-free.

- The growth shares owned by the children are now worth $3,000,000 (pre-tax).

- The taxes of $1,030,000 that would have been payable on the death of the individual are now deferred until the death of the children or when the investments are drawn out of the corporation.

- If desired, the children can do the same estate freeze once their own children are 18 years old.

Other advantages

In addition to the many benefits of estate planning, other advantages to incorporating investments are highlighted below.

Flexibility of personal income

By holding investments in a company, personal taxable income can be planned a year in advance. Investment income would flow through the company and be paid by way of redemption dividends. This has several advantages:

- An individual may choose to pay out income from the company to use low personal tax brackets each year, or leave it untouched in the company.

- Minimize Old Age Security clawback by limiting personal income below $87,000 (for 2023).

- Tax-free repayment of the loan receivable from the company.

Reduced probate costs with dual wills

In Ontario, an estate is subject to probate upon death. The current fee is 1.5% of the market value of the portion of the estate subject to probate. Assets subject to probate include investments that are held personally. Incorporating investments will reduce probate fees if an individual has a secondary will to deal separately with their company shares and loans to the company.

Minimized United States estate tax

On the death of an individual who is not a U.S. citizen or green card holder, but who holds U.S. assets (including shares of any U.S. company), there may be U.S. estate taxes owing. However, U.S. estate tax exposure could be minimized if their U.S. investments are held by a Canadian holding company.

Income splitting with family members

Usually, family members or a family trust will own the growth shares of the company. This can be attractive, as it may be possible to save income tax by paying dividends to low-income family members. For example, dividends can be paid to children over 18 years old who may need money for post-secondary studies.

Note that if the corporation has received income from a related business, the Tax on Split Income (TOSI) rules may apply to eliminate the benefits of income splitting, and tax the dividends at the highest marginal rate. This should be discussed with your GGFL advisor.

Issues to Consider

While there are significant advantages to incorporating your investments, there are also important considerations to take note of.

Corporate attribution

A complex set of tax rules exist to deter individuals from transferring income from themselves to their spouse or minor children. The estate freeze described this article is potentially subject to these rules. However, with proper planning, the attribution issue can be minimized.

Land transfer tax on real estate investments

Ontario imposes land transfer tax on real property transferred to a company. The land transfer tax rate ranges from 0.5% to 2.5% depending on the size of the transaction.

Costs of incorporation and reporting requirements

There will be legal and regulatory costs to incorporate a company, as well as legal and accounting fees to transfer the investments. There are also annual tax-deductible costs associated with maintaining the corporate minute books, preparing the company’s annual financial statements, and preparing the company’s tax returns.

21 year rule for trusts

Every 21 years, trusts have a deemed disposition of their assets resulting in tax on unrealized capital gains similar to when an individual passes away. This deemed disposition can be avoided if the trust distributes its assets to beneficiaries prior to its 21st anniversary. In this case, the shares of the investment corporation could be distributed to the next generation who could then implement a similar estate freeze and establish a new trust.

Talk to us first

Incorporating your investments is a complicated decision. Discuss the costs and benefits with your GGFL advisor before moving forward with the process.