Paul Morton, CPA, CA, CFP, TEP, Tax Partner (retired)

If you are planning to make a significant donation to a Canadian registered charity in 2017, you might want to consider stocks. Donating stocks can be a tax efficient way to make a contribution, provided that you keep the following considerations in mind.

To qualify for special tax treatment, the investment must be a publicly traded security. The most common publicly traded securities are shares, debt obligations, and mutual funds that are listed on designated stock exchanges in Canada and internationally. Donations must be made to registered charities or other approved donees, the most common of which are public and private foundations.

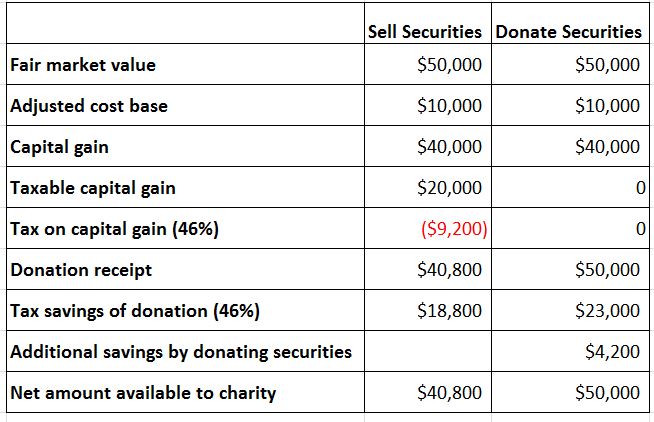

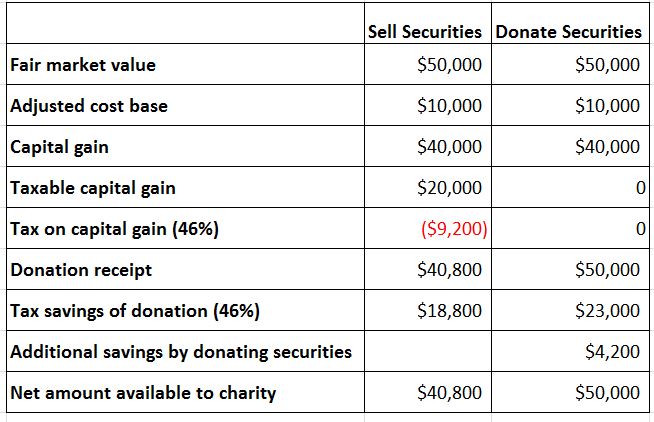

The tax treatment can be illustrated using the following example.

- You own 1,000 shares of a qualified stock trading at $50 per share that you want to donate, worth $50,000 in total.

- You purchased the shares at $10 each, for a total cost of $10,000.

- You are in the 46% tax bracket.

You can either:

- Sell your stocks, pay capital gains tax, and donate what remains, OR

- Donate the stocks directly to the charity, and let them sell the shares.

The tax consequences are shown in the table below.

In summary, by donating the shares, the donor saves $4,200 in tax, while the charity is ahead by $9,200 — a win for both parties!

Other tax considerations include the following.

- If you have an investment that has gone down in value, you will want to take a different approach. You are better off to sell the security and create a capital loss (with no taxes payable) and donate the cash. Capital losses can only be applied against capital gains. They can be carried back up to three years and carried forward indefinitely.

- In Ontario, for individuals earning more than $220,000, a cash donation of $100 will save $53.53 in income tax.

- Unused donations can be carried forward for up to five years to reduce taxes payable in future years.

- For couples, it is generally better for the higher-income spouse to claim donations.

- Starting in 2016, donations made in your will can be applied in the year of death, the preceding year, or they can be carried forward for up to five years in your estate.

- If you plan to leave all or a substantial portion of your estate to charity, your estate may not need the entire donation credit to eliminate taxes payable. Consider making donations during your lifetime to eliminate taxes payable, both during your lifetime and on your death.

Conclusion

Always speak with your accountant when planning how to meet your philanthropic goals. A slight adjustment can save significant taxes for you, and provide more funds to the charity you want to support.